- Quickbooks pay sales tax not listed how to#

- Quickbooks pay sales tax not listed manual#

- Quickbooks pay sales tax not listed mac#

Use automated sales tax on an invoice or sales receipt. Set up and use automated sales tax in QuickBooks Online. I'll be adding a few related articles for you to be familiar with Automated Sales Tax: To do that, simply click the Select tax rate drop-down on the transaction and choose Add rate. This option gives business owners the flexibility with their sales tax processing and helping them report the correct amount to the tax agency. If the calculation of taxes does not coincide with the actual rate because of additional local and county taxes, you can always create a custom rate for it. We want to help you with applying the correct sales tax amounts to every location you create a sale, Automated Sales Tax feature determines the rates based on the customer's billing and shipping address on the sales form. Thanks in advance for any help you can give.

I inherited the system, but it's never been this odd.

Quickbooks pay sales tax not listed mac#

Should I be handling the downpayments differently? I've been using QB Mac for 20 years and have never had this issue. I switched to QB Desktop Mac 2020 over the winter. That doesn't make sense and is sure to raise a red flag in the State Sales Tax Audit Department! I looked back at June 2019 and this didn't happen. My sales tax report this month is picking up all those negative downpayments as non-tax sales (but as revenue, not a liability), meaning that my non-tax sales are negative and making the Taxable Sales amount larger than the Total Sales Amount. When the client's bill is bigger than the initial downpayment, I subtract the amount of the downpayment, leaving the amount due. I record the downpayments on sale invoices, item DOWNPAYMENT, listed as OTHER CHARGE. Most of my clients "hit" their downpayment amount in the month of June. We collect downpayments at the beginning of the season and apply them to work as we do it.

Quickbooks pay sales tax not listed how to#

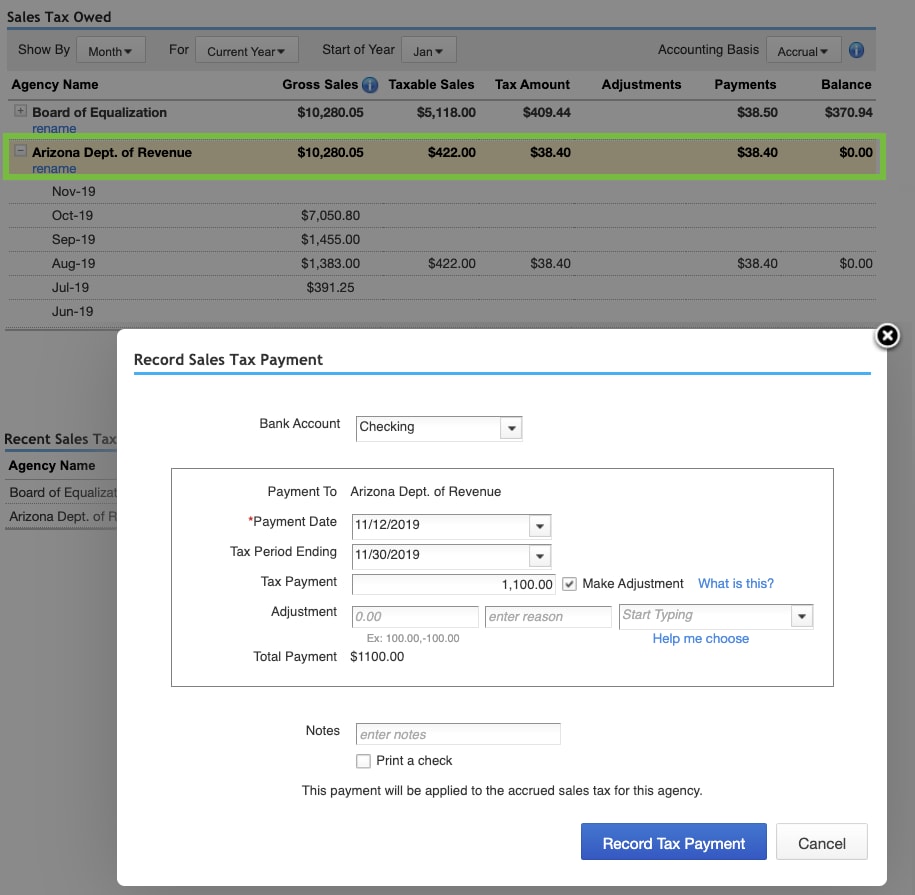

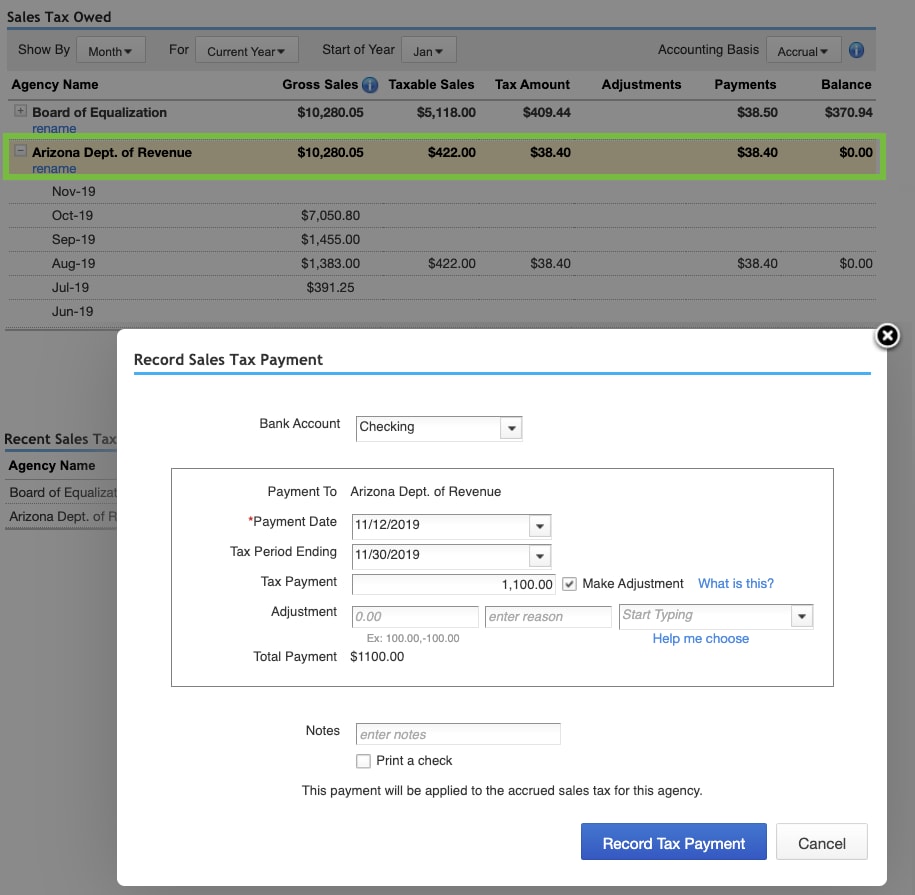

Select the Agency you file payments to, then select the agency for each rate you need to group as one custom rate.Ĭheck out this link to know more about how to use custom tax rates on your next invoice or sales receipts. you can enter a nickname for each rate if you're adding a combined rate as one. Click the Sales tax settings, then click Add rate in the Custom rates section. Go to the Taxes menu, then select Sales tax. While we're waiting for the resolution, you can use the custom rates to manually calculate taxes on invoices or receipts. Quickbooks pay sales tax not listed manual#

At the moment, the investigation is still In Progress status.Īlso, switching back to manual sales tax isn't available in QuickBooks Online. I appreciate you for trying the basic troubleshooting to resolve the sales tax issues, 8031_dp20. Keep me posted if you need a hand with running sales tax reports or any QBO related. Wishing you and your business continued success in all that you do. I've got a link here where you can find articles about managing sales tax in your account.

Choose Message an agent to connect with our support. Enter a short description of your concern. Tap the Contact Us button at the bottom. This way, you won't have to wait on the line. Just request a callback from our support agent. They'll pull up your account in a secure environment and add you to the list of affected users. Once done, please reach out to our Customer Support Team. In the meantime, just manually override the tax rate on the invoice. Our engineers are still working on the permanent fix. If you're referring to the Location of Sale box turns blank and reverts sales tax rate upon saving invoice using the automated sales tax settings, then we have an ongoing issue about this one. Also, it will automatically calculate the total tax rate for each sale based on the following:įor more details about sales tax calculation, check out this article: Learn how QuickBooks Online calculates sales tax. May I know what problems you encountered with the new sales tax system? QBO tracks your state’s tax laws to accurately calculate sales tax and returns using the Automated Sales Tax feature.

Choose Message an agent to connect with our support. Enter a short description of your concern. Tap the Contact Us button at the bottom. This way, you won't have to wait on the line. Just request a callback from our support agent. They'll pull up your account in a secure environment and add you to the list of affected users. Once done, please reach out to our Customer Support Team. In the meantime, just manually override the tax rate on the invoice. Our engineers are still working on the permanent fix. If you're referring to the Location of Sale box turns blank and reverts sales tax rate upon saving invoice using the automated sales tax settings, then we have an ongoing issue about this one. Also, it will automatically calculate the total tax rate for each sale based on the following:įor more details about sales tax calculation, check out this article: Learn how QuickBooks Online calculates sales tax. May I know what problems you encountered with the new sales tax system? QBO tracks your state’s tax laws to accurately calculate sales tax and returns using the Automated Sales Tax feature.

Let me share some information about the new sales tax feature in QuickBooks Online (QBO), giudidetorres.

0 kommentar(er)

0 kommentar(er)